2019 ConsenSys Hackathon ![]() github

github ![]()

This wiki page is best supported by journal

digraph { node [shape=box style=filled fillcolor=white] "Satoshi\nvs\nSiegelaub" [ tooltip="ucla.viki.wiki ucla.viki.wiki" fillcolor="0.611 0.2 1.0"] "The\nArtist's\nReserved\nRights\nand\nTransfer\nof\nSale\nAgreement" [ tooltip="ucla.viki.wiki ucla.viki.wiki" fillcolor="0.611 0.2 1.0"] "Satoshi\nvs\nSiegelaub" -> "The\nArtist's\nReserved\nRights\nand\nTransfer\nof\nSale\nAgreement" }

>We define an electronic coin as a chain of digital signatures. Each owner transfers the coin to the

next by digitally signing a hash of the previous transaction and the public key of the next owner

and adding these to the end of the coin. bitcoin ![]()

Project archived on Dev Post ![]()

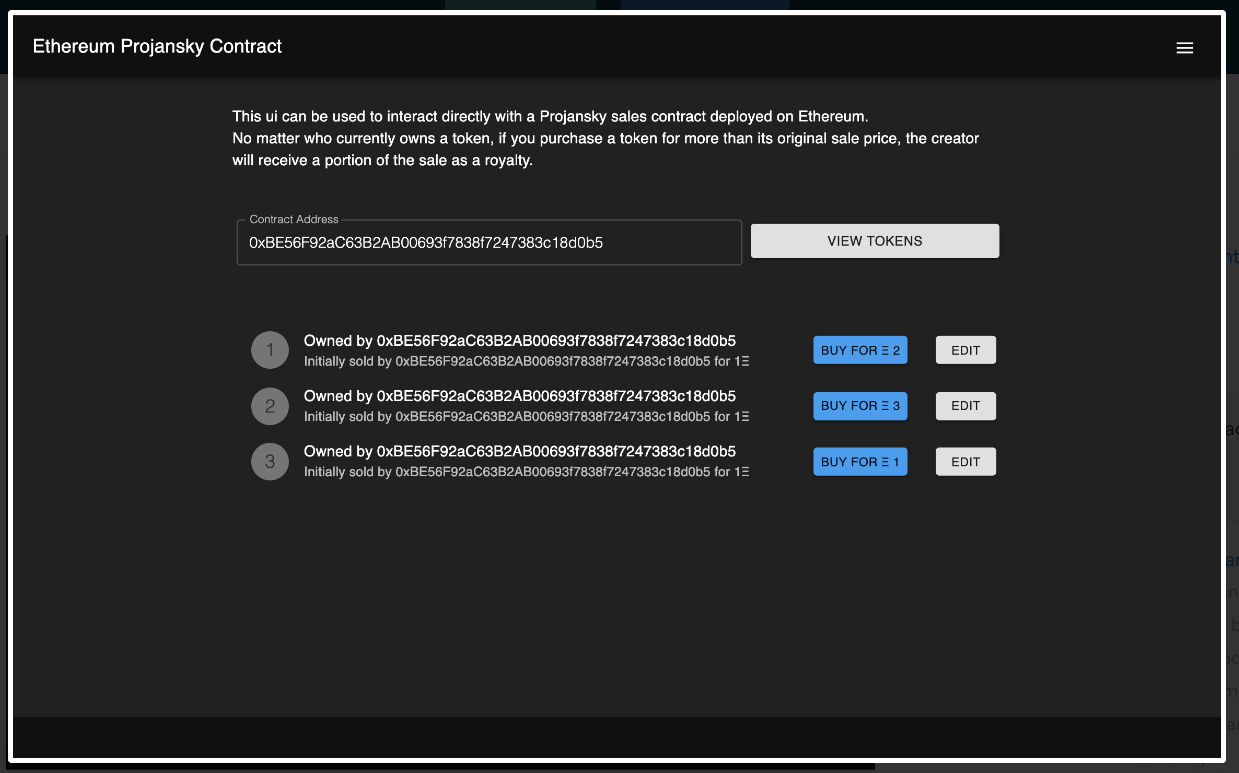

In 2019, Patrick Steadman, Varun Vasudevan and I asked whether or not The Artist's Reserved Rights and Transfer of Sale Agreement canonic ‘Projansky Deal’ was constitutes a "peer-to-peer chronological timestamping system" (Bitcoin whitepaper) in that it functions as a “peer-to-peer database that stores information and enables the secure transaction of assets” and (like Ethereum) operates as a matrix of accountability through which transactions can be secured.

The contract can be used with any ERC721 tokens that represent artwork or other assets. According to this contract, when an asset gets resold, the creator will automatically receive a certain royalty percentage of the piece sold. The functionality can be extended to include exhibition history and collection data.

The Projansky (Smart) contract was part of an ensemble of efforts by Visit, Inc., the start-up I founded alongside Patrick Steadman, to develop a social software for the art world that was resonant with the values of that community. This included a decentralized, federated networking protocol for studio visits as well as an open-source, epub network for the sharing of MFA course syllabi, reading lists and the like.

When we pitched these ideas to tech VC’s, we found ourselves having to contend with the ever-ubiquitous question: “What problem are you trying to solve?” Given that art, by definition, does not have a use-value in the traditional sense (and is by nature already “disruptive”), we found ourselves having to develop software from the standpoint of art’s ontology. We soon decided that the problem of art is the problem of value. Period.

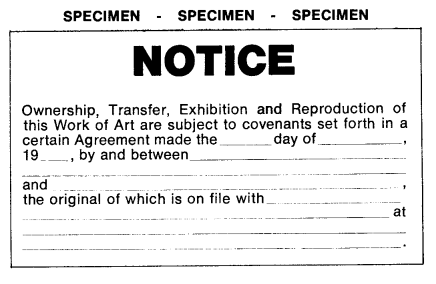

While the Projansky Deal has been well documented (and the problems, pitfalls, & possibilities of such an effort hotly debated), attention has mostly been placed on the Artist’s Contract as a royalties agreement. However, the open-source legal document (the conditions of which can be adjusted) is also a networking protocol.

One ambiguity within the existing contract is the shift between what the contract does (ensures the artists receives 15% of the resale value of a work of art, transaction records, etc.) and what the contract provides (rights).

Because rights are constituitive-- shifting the relationships and balance of power between participants-- and because, often, the transfer of a work of art produces an increase in its value, we wondered if the popular conception of the document as merely a royalties contract has not in fact been overemphasized.

Three years after we developed our prototype, use-cases for the ERC721 token have exploded into a marketplace for non-fungible tokens. NFT’s mostly take the form of digital commodities. Our protocol makes it possible to generate an NFT for a work of art for the purposes of structurally embedding the Artist’s Contract into a work of art, along with any relevant meta-data, such as exhibition history.

Because the exhibition trajectory of a work is the primary factor when it comes to an artworks financial valuation, our hypothesis was that a Projansky (Smart) Contract has the potential to encode the historical dimension of a work of art into the token itself - a far cry from present-day conversations concerning the online sale and distribution of digital assets.

The answer to the Jeopardy-style question in the above image is, of course, “What is Las Meninas?” The problem of art is the problem of value. Using Velazquez’s Las Meninas as a metaphor for the encapsulation of value production in art, our presentations attempted to make the complex (and often confusing, especially to outsiders) process of art’s value formation intelligible to non-art audiences.

Contemporary art is (ironically) a futures market. The art market consists largely of transactions between private individuals (who often wish to keep information regarding sales and acquisitions private) and galleries or independent dealers (who discourage the direct-to-consumer model espoused by Silicon Valley.)

This is one reason the Projansky Contract has been criticized by market operators and why its implementation has so far been limited. The relationship between the art market and the art institution is one of regulation-- the art institution backs the value of a work of art via art historical sanctioning.

What makes the blockchain, in general, misleading is the oft-espoused notion of “cutting out the middleman” -- Satoshi Nakomoto’s 2008 bitcoin whitepaper risks the form of scientific documentation by presenting the use-case of bitcoin in ideological terms.

While bitcoin may exist as a critique of fractional-reserve banking, the problem that blockchain technology was designed to solve is one of source congruency (see Byzantine Fault).

A byzantine fault occurs when a fault presents different symptoms to different observers. The art market can be looked at in these terms.

Currently, the only hard data with which to properly gauge the monetary value of an artwork comes from auction results. This makes the art market highly volatile. (The platform, Art.sy, has been perhaps the most effective effort on the part of the market to extend art institutional sanction to the commercial sector in that it editorializes market data-- an attempt to historicize trends in consumer preferences.)

The impact of this is that arts historical trajectory (measured over decades) risks becoming contaminated by the short term effects of transactional modes of participation (such as flipping).

Whether the Projansky (Smart) Contract can offset inflation in the art market by preserving (on a public ledger) a record of transactions has yet to be determined. Because the blockchain affords users anonyminity, the art world’s “private, ‘cash-based’, and informal nature” is left undisrupted. Regardless of the impact of such a proposal, we developed the Projansky (Smart) Contract in a manner true to the ethos of the original contract with the aim of “remedying some generally acknowledged inequities in the art world, particularly artist’s lack of control over the use of their work and participation in its economies after they no longer own it.” Given that “capital” in the art world is often immaterial, social, and generated by proximity rather than production, we maintain that the issue of artists royalties, while important, is the most arbitrary dimension of the Projansky Deal. What must be emphasized instead is the potential for alternative financial networks, shifts in institutional framing, and the relational dimension of market participation.

While Visit, Inc. is no longer in operation, we invite anyone to fork our code from github in order to continue developing Seth Sieglaub and Bob Projansky’s decades-old, open-source protocol.